Market Meltdown: Global Economy Reels from Surprise Trade War Escalation

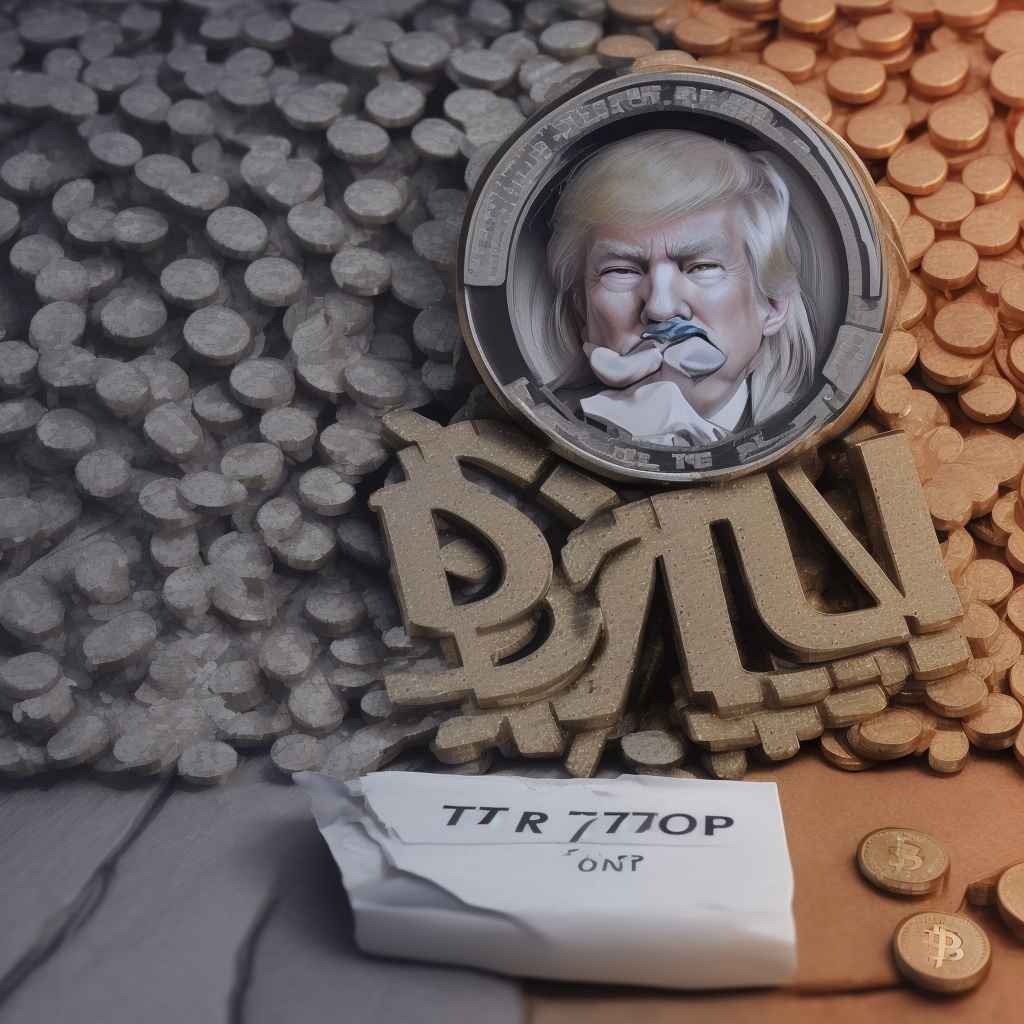

Bitcoin Price Just Crashed 7%: Trump Tariff Shock

The cryptocurrency market has taken a hit after the United States implemented new tariffs on Chinese goods. The price of Bitcoin (BTC) has plummeted by 7%, with other major cryptocurrencies also experiencing significant losses.

The tariffs, which were announced by President Donald Trump yesterday, have sent shockwaves through the global economy. The move is expected to have far-reaching consequences, including increased costs for American consumers and businesses.

The impact of the tariffs on the cryptocurrency market has been swift and severe. Bitcoin, which had been trading at around $8,500 just yesterday, has fallen to around $7,900. Other major cryptocurrencies, including Ethereum (ETH) and Ripple (XRP), have also experienced significant losses.

The crash has been attributed to a combination of factors, including the uncertainty surrounding the tariffs and the potential impact on global trade. The move has also been seen as a negative sign for the global economy, which has already been experiencing signs of slowing growth.

For cryptocurrency investors, the crash has been a sobering reminder of the volatility of the market. The price of Bitcoin has experienced significant fluctuations over the past year, and the crash has left many wondering what the future holds for the cryptocurrency.

Despite the crash, many experts believe that the long-term potential of Bitcoin and other cryptocurrencies remains strong. The move towards decentralized finance and the increasing adoption of cryptocurrencies by mainstream businesses are seen as major drivers of growth in the market.

In the meantime, investors are bracing themselves for further volatility in the market. The crash has left many wondering what the future holds for the cryptocurrency market, and whether the tariffs will have a lasting impact on the global economy.