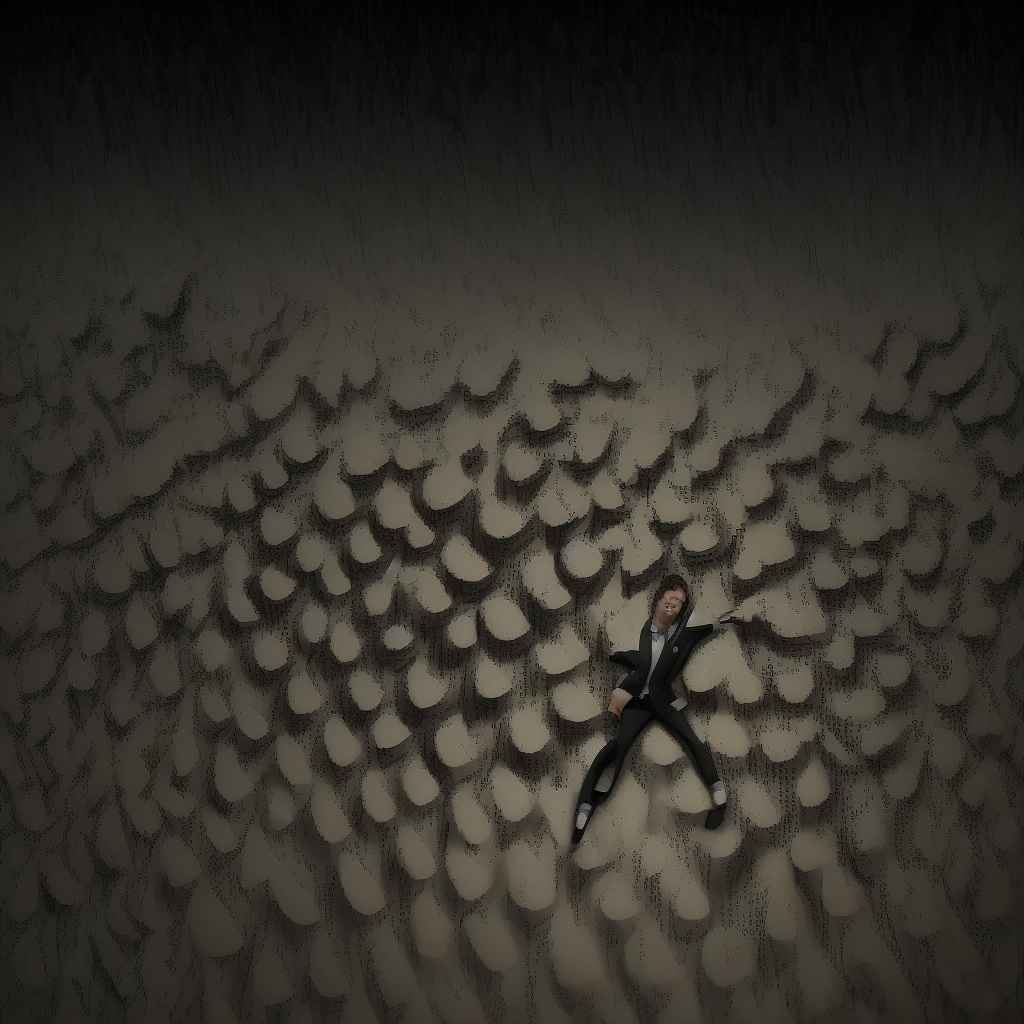

Market Sentiment Balances As Fear And Greed Index Reaches Neutral Point

Bitcoin Investors' Anxiety Eases as Price Stabilizes

In a much-needed respite for anxious investors, the price of Bitcoin has stabilized over the past week, bringing relief to those who had been worried about a potential correction. The world's largest cryptocurrency by market capitalization has been trading within a narrow range, between $6,400 and $6,700, sparking a sense of calm among investors who had been bracing for a downturn.

The stabilization in price comes after a tumultuous few weeks, during which Bitcoin's value plummeted by over 15% due to concerns over regulatory uncertainty, the collapse of cryptocurrency derivatives exchange BitMEX, and the ongoing impact of the COVID-19 pandemic on global markets. The sudden and sharp decline had left many investors on edge, wondering if the worst was yet to come.

However, as the dust settles, investors are breathing a sigh of relief as the price of Bitcoin appears to have found a floor. The stability has been attributed to a combination of factors, including the resilience of the cryptocurrency's underlying technology, the continued interest from institutional investors, and the growing recognition of Bitcoin's potential as a store of value and hedge against inflation.

"It's been a wild ride, but I think we've finally seen the bottom," said Alex Kruger, a cryptocurrency trader and analyst. "The fundamentals are still strong, and I think we'll see a steady recovery from here."

The stabilization in price has also had a positive impact on the broader cryptocurrency market, with many altcoins and smaller cryptocurrencies also experiencing a rebound. The increased confidence has led to a surge in trading activity, with many investors looking to capitalize on the renewed optimism.

While some may still be wary of the potential for another correction, the stabilization in Bitcoin's price has brought a sense of relief and renewed optimism to the market. As the cryptocurrency continues to navigate the ever-changing landscape, investors will be keeping a close eye on developments, eager to see if the current upswing can be sustained.